Table of Content

- Will I Get Any Money Back From My Taxes

- Choose Between a Standard or Itemized Deduction

- When a home equity loan results in a tax break

- Acquisition debt vs. home equity debt: What’s the difference?

- Can I Deduct the Interest on My Home Equity Loan?

- Not all home equity loan interest is deductible

- Claiming a home equity loan interest deduction

You may want to complete online prequalification with a few lenders, which can give you a sense of the terms and rates theyre offering, as well as the fees theyll charge. The IRS grants an exclusion on real-estate capital gains up to $500,000 for married couples filing jointly, and $250,000 for singles . However, you must have lived in the home for at least two of the last five years prior to its sale. For example, if you bought a home a few years back for $300,000 and sold it today for $900,000, youd make a $600,000 profit. So if youre married and filing jointly, as little as $100,000 of your gain could be subject to tax. But if youre using the money for other expenses , the tax deduction is no longer allowed.

If you have a second home that you don’t hold out for rent or resale to others at any time during the year, you can treat it as a qualified home. This is the home where you ordinarily live most of the time. You can’t deduct home mortgage interest unless the following conditions are met. Go to IRS.gov/Forms to download current and prior-year forms, instructions, and publications.

Will I Get Any Money Back From My Taxes

Home equity loans use equity in the borrower’s home as collateral. Taking out a home equity loan therefore means putting the borrower’s home at risk. If the borrower fails to pay back the loan, the lender can foreclose and sell the home to pay off the debt. This means that your total mortgage debt can’t exceed $750,000 to deduct the interest.

Unless you have an exceptionally large HELOC or home equity loan, the interest paid on it is unlikely to be the deciding factor in taking the standard deduction or itemizing deductions. If you are already itemizing your deductions, then choosing a HELOC or a home equity loan over something like a personal loan so that you can deduct the interest may make the most financial sense for you. Keep in mind that the attractiveness of a HELOC—and its deductibility—can change if interest rates rise.

Choose Between a Standard or Itemized Deduction

Typically, HELOC rates move in step with rate increases by the Fed. You can use Patelco’s home equity loan and line of credit calculatorto see how much you can borrow from your home. If you'll need a fixed amount of money all at once for a certain purpose (e.g., remodeling the kitchen or paying off other high-interest debts), you might want to take out a home equity loan. If you sell shortly after borrowing the money, the cost of obtaining the financing may undercut your profit in the sale. Additionally, the cost of obtaining an equity line of credit might be prohibitive if you only draw a small amount from it.

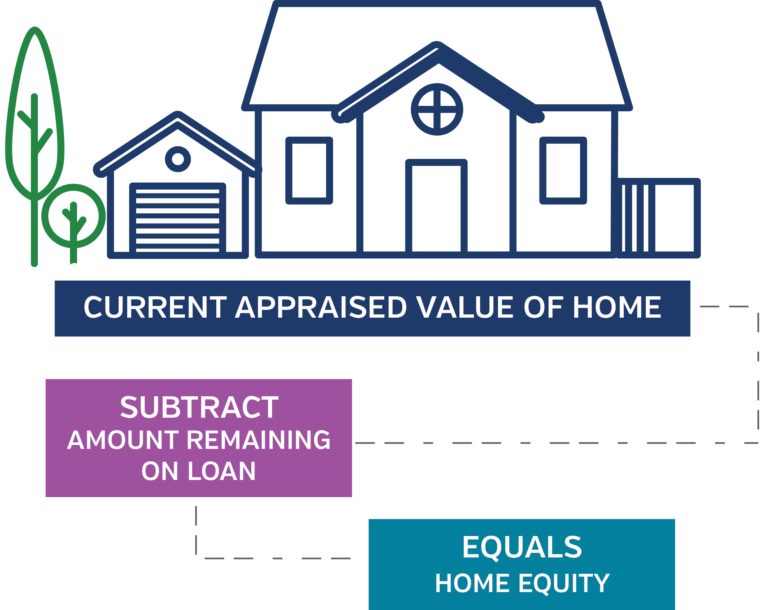

A home equity loan lets you borrow against the value of your home, using the equity you’ve accumulated as collateral. This new tax rule applies toallhome equity debts, as well ascash-out refinancing. That’s where you replace your main mortgage with a whole new one, but take out some of the money as cash. “Home equity debt interest is no longer deductible,” saysWilliam L.

When a home equity loan results in a tax break

According to a September 2022 report by CoreLogic, in the first quarter of 2022, the average U.S. homeowner gained nearly $64,000 in equity compared to the first quarter of 2021. We’ll find you a highly rated lender in just a few minutes. Many or all of the products featured here are from our partners who compensate us.

A Form W-9, Request for Taxpayer Identification Number and Certification, can be used for this purpose. Failure to meet any of these requirements may result in a $50 penalty for each failure. The TIN can be either a social security number, an individual taxpayer identification number , or an employer identification number . The amount of mortgage insurance premiums you paid during 2022 should be shown in box 5 of Form 1098. If you prepaid interest in 2022 that accrued in full by January 15, 2023, this prepaid interest may be included in box 1 of Form 1098.

Acquisition debt vs. home equity debt: What’s the difference?

Here’s what you need to know about home equity loan taxes when you file this year. Do you have a home equity loan orhome equity line of credit ? Homeowners often tap their home equity for some quick cash, using their property as collateral. But before doing so, you need to understand how this debt will be treated come tax season. Investopedia requires writers to use primary sources to support their work.

So high-income taxpayers will find less benefit in opting to itemize their interest payments on home equity loans. Interest on home equity loans has traditionally been fully tax-deductible. But with the tax reform brought on by President Trump’s Tax Cuts and Jobs Act , a lot of homeowners are struggling to work out whether they can still take a home equity loan tax deduction.

Otherwise, you can deduct interest on a home equity loan that's secured by either your primary or secondary home. See Part II. Limits on Home Mortgage Interest Deduction, later. However, the statement shouldn't show any interest that was paid for you by a government agency. The standard deduction will have risen slightly by the time you file your taxes. The standard deduction will be $24,400 for married couples filing jointly and $12,200 for taxpayers filing as individuals. Possibly, depending on your mortgage debt and when you borrowed the money.

The interest you pay on a mortgage on a home other than your main or second home may be deductible if the proceeds of the loan were used for business, investment, or other deductible purposes. Otherwise, it is considered personal interest and isn't deductible. From first checking accounts to saving for retirement and everything in between, our innovative products and services are designed for every style and any stage in life.

No comments:

Post a Comment